With the new Aeroplan program only a few short months away from launching the marketing efforts from them and their financial partners are going to start ramping up. Given that travel has been curtailed for the better of almost half a year now credit card issuers moved money away from their travel card portfolios and that included TD with their Aeroplan cards. That’s starting to change now – travel is slowly coming back and of course with Aeroplan going ahead with launching their new program in November efforts are returning to the marketing of these cards. It all starts today with the TD Aeroplan Visa Infinite Card seeing its welcome bonus boosted 10,000 Aeroplan Miles (soon to be points) from 15,000 to 25,000 while retaining the no first year annual fee on both the primary card and the first additional card. This offer is available for new applications until November 7 (which makes total sense seeing the new Aeroplan cards launch on November 8) This means as long as you can meet the minimum spend requirement of only $1,500 in the first three months you’ll get the full 25,000 miles at no cost outside of that spending.

Now the real question you have to ask yourself is “do I get the card now or do I wait for the new cards to launch in November?” This is question we here at Rewards Canada do not have the answer to but sure wish we did. Here are some things you’ll want to consider and right now the predicament we are in is just like playing the stock market. Do you play it safe by jumping in now or do you risk it and wait for a potential bigger reward but also stand a chance at being rewarded less?

If you choose to go sign up for the card now here’s what you can expect:

- Your cards will be automatically updated to the new version of the card on November 8 along with all the new bells and whistles

- You’ll get the annual fee waived for the primary card and first additional cards. That’s $120 and $50 savings based on the current version of the cards. However the new version of the card will be $139 and $75 and you won’t have to pay that until the first year anniversary of the card. By signing up now you are essentially locking in the new card with all the new benefits for at least 10 months with no cost. My gut tells me when the new cards come out in November they will not be waiving the annual fees.

- A smaller welcome bonus. Chances are when the new card offers are revealed for November the welcome bonus will be bigger and better. How much bigger and better? We don’t know. Will it be so much more higher that it’s worth waiting and paying the $139 fee (and $75 for additional cards) if they don’t waive the annual fee in the first year as of November 8?

- You’ll get 25,000 miles that you can start using sooner than if you wait for the new cards

- You only have to spend $1,500 to get the full bonus from this current offer. I am anticipating that the new card will have a higher spend requirement but again this is just speculation.

If you choose to play with fate and want to risk it by waiting until November 8 here’s what you can expect:

- You’ll have the new card with all the bells and whistles

- You will likely be able to earn more points thanks to a bigger welcome bonus. This is pure speculation but if Aeroplan and TD really want to come out guns a-blazing you can bet the bonus will be big.

- There is high likelihood the annual fee will not be waived thanks to a large welcome bonus offer. Aeroplan and its partners need to play their cards correctly here – offer a big bonus with no annual fee right off the bat and you really open it up to gamers as you are doling out a lot of points at a big cost. On the other hand many of the benefits associated with the new version of card won’t be overly utilized for some time still due to the severe downturn in travel so that savings may somewhat offset offering an annual fee waiver. It is a crap shoot right now.

- You may have to spend more to achieve the welcome bonus on this new card. The current offer only requires $1,500 in spending in the first three months and I am guessing that requirement will be higher come November 8.

Like I already mentioned in this post – I don’t have the answer to what the new card will offer as a welcome bonus. All I have written above is pure speculation and can be totally wrong. I’m just putting it out there so that you can consider your path, ultimately choosing your own adventure. Will you play it safe or take a risk? It’s all up to you and the page you choose.

Now if you choose to go with this current offer, which by the way is quite good in its own form you are looking at receiving 10,000 miles upon your first purchase and another 15,000 miles when you spend $1,500 on the card within the first 90 days of opening your account. For most people this shouldn’t be too hard as that will equate to $500 in spending per month.no fee etc. However if you want to be able to get the miles as soon as possible you’ll want to try to get that $1,500 in spending done quickly so that the miles post after your first statement. That way you can still redeem the miles under the old award chart system that will be in effect until November 7. Here is a broad example of what 25,000 Aeroplan Miles can get you under the current program:

- 3 one way economy class short haul flights in Canada & Continental USA

- 1 round trip or 2 one way economy class long haul flights in Canada & Continental USA

- 1 one way economy class ticket from Canada to Hawaii, Mexico, Caribbean, Central America, or Northern South America

- 1 one way business class long haul flights in Canada & Continental USA

|

| Air Canada reward chart valid only to November 7 |

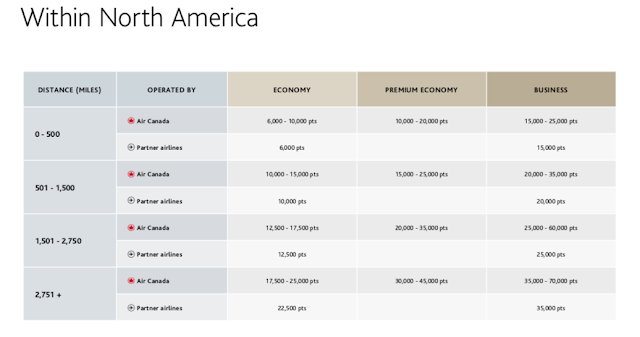

As of November 8th the above chart will no longer be applicable as the new Aeroplan program will be live. Here is what can expect for those 25,000 miles in the new program:

- 2 to 4 one way economy class flights (0-500 miles)

- 4 one way economy class flights on partner airlines (0-500 miles)

- 1 to 2 one way premium economy class flights (0-500 miles)

- 1 one way business class flight (0-500 miles)

- 1 to 2 one way economy class flights (501-1,500 miles & 1,501-2,750 miles)

- 2 one way economy class flights on partner airlines (501-1,500 miles & 1,501-2,750 miles)

- 1 one way premium economy class flight (501-1,500 miles)

- potentially 1 one way business class flight (501 – 1,500 miles)

- 1 one way business class flight on partner airlines (501-1,500 miles)

- potentially 1 one way premium economy or business class flight (1,501-2,750 miles)

- 1 one way economy class flight (2,751+ miles)

|

| Air Canada’s new redemption rates (click to make bigger) |

The 25,000 miles will also cover some flights within select other zones such as for flights within Asia or within South America. The new program also allows for points plus cash redemptions so while 25,000 miles may not cover an entire flight to Europe or Asia you can use towards a portion of the flight and pay cash for the remainder. This is one of the great new benefits of this program is that increased flexibility.

Another great benefit of the new program is the Family Sharing plan you will be able to create a group of 8 people to pool points from to make it easier to reach those reward goal. Savvy collectors take note – get yourself two cards if you can with this current promotion and you’ll have 50,000 Aeroplan Miles which will open up even more redemption options. For example you get your own TD Aeroplan Visa Infinite Card then have your spouse or partner get their own account as well. As long as you are both approved and both meet that minimum spend threshold you’ll each have 25,000 miles that you can pool into one come November 8. And the great thing is both of you pay no annual fee on the cards for that first year. This can also be a way to curb the risk of waiting in some sort, perhaps apply for one card right now to get the 25,000 miles with no fee and then have the partner/spouse wait to November 8 to apply for the new card with whatever sign up bonus it comes with.

There you have it! TD’s new offer for the Aeroplan Visa Infinite card definitely presents a dilemma as it raises the question, do I get the card now or do I wait until November 8. I wish I could answer that for you but your guess is as good as mine right now. Hopefully though I was able to present enough information in this post to at least give you a little more guidance as to making the right choice for you.

Learn more about and apply for the TD Aeroplan Visa Infinite Card here.

The card matrix below shows the latest offer on this card and may not be representative of the discussion above: