June 1st saw the launch of another tool to help points and miles enthusiasts make the most of their loyalty currencies. That tool is Points Navigator* and what it does is rank credit cards based on dollar values, organizes the cards you have in your portfolios, keeps track of approval rules and more. The company is not affiliated with any credit card issuers or banks so they don’t rank or give advice based on commissions or advertisements. With no affiliations the results should be totally unbiased for each user.

The team at Points Navigator has put together a video giving an overview of the site:

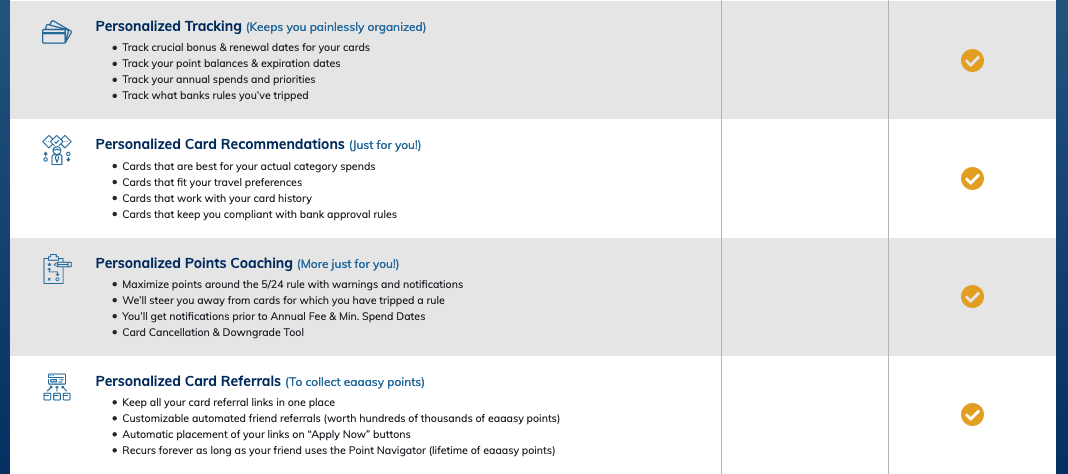

There are two membership options for Points Navigator – the free feature option and the Insider option which runs $9,99 per month or $95 per year or $250 for three years. Here is what each option provides:

As you can see you get most of the site’s tools at no cost to you. If you want to add in the personalized options you can subscribe to Insider Option. Note the last option – they let you place your referral links into the site so that if you refer or send anyone to the site Points Navigator will populate your link into those cards presented to that user. This means you’ll earn your referral points/miles approval if they are approved for any of the card recommendations you have a referral link for. They are also working with Award Wallet to have your loyalty program balances integrated into their sit.

What Makes Point Navigator Different?

(The following was provided by Points Navigator)

Comprehensive card ranking and filtering:

Most sites rank 15-30 cards. We think inclusion of all potential cards is vital for a user’s ability to trust the rankings. The ability to filter and sort by virtually any category a user wants (e.g. which cards won’t count towards 5/24) adds usability no other site has.

Advanced formulas for objective rankings:

We purposefully bring objectivity and transparency to all factors in our rankings. As these automated calculations build on each other, what’s created is a level of detail and inter-relationships no one could ever accomplish with a spreadsheet.

Hyper organized and inter linked:

Blog formats are great for engaging articles. But when it comes to handling numbers and relative opportunities that are changing constantly, a highly organized database-driven solution offers a different approach we think people will appreciate.

Daily updating of everything:

We have a full-time person dedicated to updating everything daily. Even more, our structure allows for one change in the database to update 15 associated pages, and all site formulas, instantly.

Spend category rankings:

We rank cards for every spend category by cents back on every dollar spent, instead of just a meaningless X factor.

Benefit rankings:

We rank cards for every benefit. Not just a few cards, but every card that has a given benefit, with all of the details.

Keep track of your card history:

Everyone in the points game has some (often faulty) method for tracking their card history. Putting your history into the Points Navigator, though, unlocks a world of personalized features. And we make it as painless as possible.

Rule tracking at a detailed level:

Using card history to eliminate cards from your recommendations isn’t totally new. But what makes us completely unique is telling a user which rules they’ve tripped; which cards tripping that rule(s) disqualifies; and the date that rule will “fall off.” We even tell them their exact 5/24 status at all times.

Personalized coaching document:

No one likes reading stuff that doesn’t apply to them. A beginner will need to understand basic guidelines about the points collecting hobby (and site). While someone who has been playing the game for years will need very different advice. We’ve developed a coaching document. But it varies for every combination of five personalizing questions.

Personalized, filterable card recommendations:

Everything we’ve mentioned so far comes together on a user’s personalized card finder page. What makes this tool unique is that a user can filter by virtually anything. To discover what cards pop back up when your 5/24 falls off, uncheck the box. To find the business American Express card best for your exact situation, filter it down in a couple clicks.

Keep track of points and award extras:

Award Wallet does a great job of using sites to auto-update users’ points, so we are automatically integrating with them. If users want an easier way to just load their points in quickly, we’ve built in that option as well. A unique feature is that we automatically load award extras from users’ cards, like free hotel rooms or airline credits with expiration dates. We also send an automated email 45 days prior to expiration.

Transfer options and retained valuation:

Keeping track of your various points’ transfer partners can make a big difference. But it’s a daunting task to know everything about point transfers — even for experienced point hobbyists. So we’ve integrated point transfer options throughout the site. Not only do we display the transfer ratio, we give a retained value percentage as a guideline for the best transfer values.

Potential points for every other system:

When a user puts their points into the site, we’ll tell them exactly how many potential transfer points they have for any point system that accepts their points. Seeing all the transfer partners and potential point totals will give users confidence in how many travel options they truly have.

Automated email reminders:

We send optional email reminders on the following: 15 days left on minimum spend; 45 days to annual fee; 5/24 strategy timing passing; 45 days to award extras (like free hotel rooms) expiring and referral links expiring. Never miss a key date again.

Coaching warnings and advice on applying:

Apply for a card using a link from the site, and we’ll check all your rules again to make sure you’re likely to be approved. We’ll tell you how applying will impact your 5/24 status, and we’ll give you reminders to help approval success for that bank. All automated, as it takes you to the best offer available.

Card referrals:

Our application links programmatically update based on who referred a user. So as a partner, those links are updated to yours on every card referral link you enter. If you don’t enter a link, or it expires (6 months), it defaults back to the main site’s links.

—

When you are on the site you can choose from options like “Card Rankings” and the sort the cards by airline, business, personal and other options:

Which you can then filter even further with these options:

And a small example of the results when I filtered for American AAdvantage:

I started fiddling around with the site a few days ago and my first impressions are that I do like it. I especially like the fact that they are not affiliated with any of the card issuers so there is no influence from potential commissions. They are planning on launching a Canadian version in the near term at which point I will give it a more in depth trial since I am Canadian based and all my cards are issued up here.

Learn more about and sign up for Points Navigator here.*

If you are from the U.S. and are planning to give it a shot please comment below as we’d love to hear your feedback on the personalized options of the website!

* FFB receives a small commission for anyone who chooses to use our link and purchase an Insider membership. You don’t have to use our link but thank you in advance if you choose to do so to help support FFB